Pre-Qualified vs Pre-Approved: What's the Difference?

Table of Content

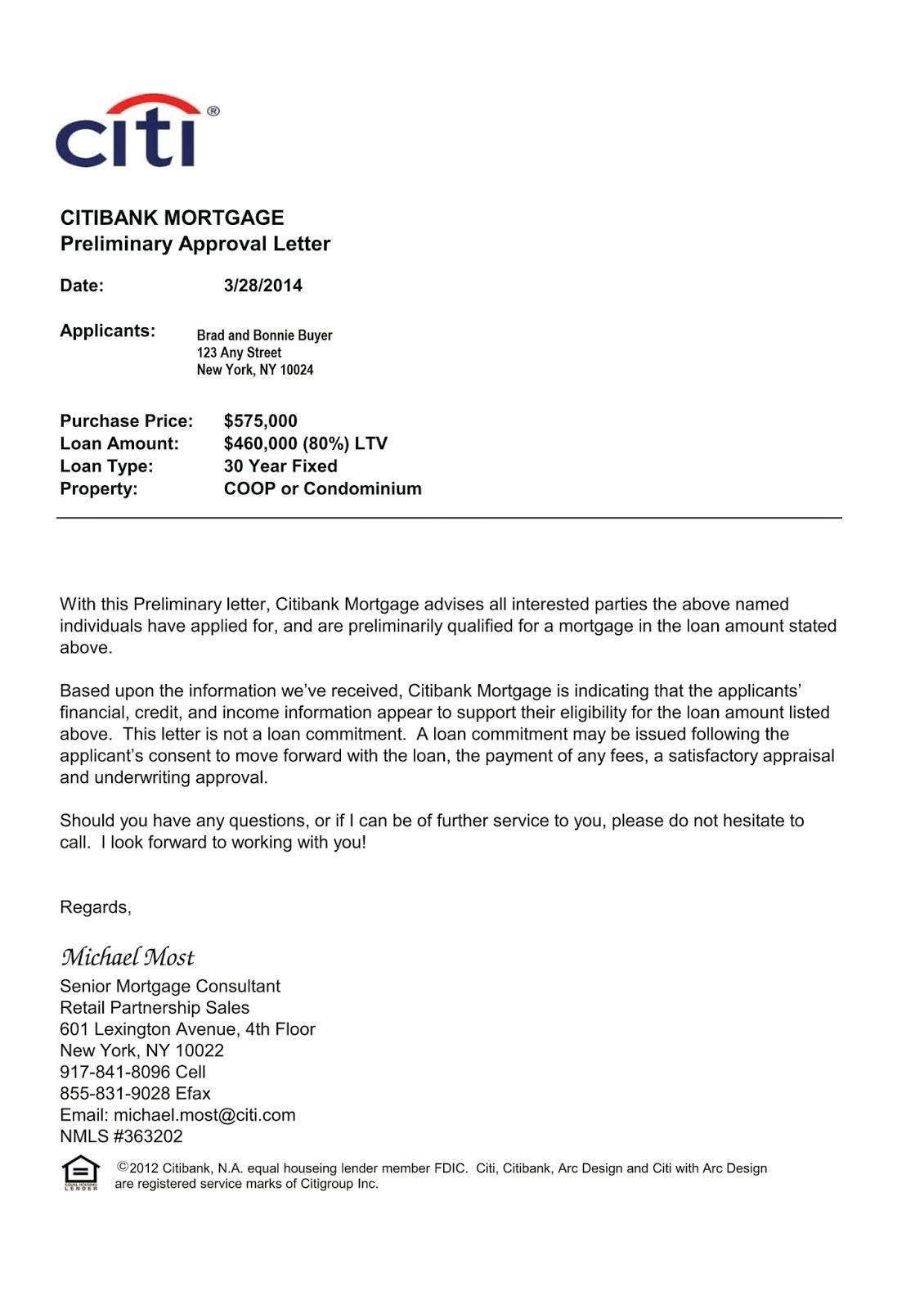

When you apply for pre-approval, the lender will take into consideration your overall financial situation, and typically need to verify your identity, income and expenses. This involves providing paperwork such as payslips and proof of any other sources of income such as bonuses or of rental income, plus details ongoing expenses. When you come in with mortgage pre-approval, it sends a message to a seller that you're a serious buyer whose finances have already been vetted by a lender. That should give your seller some reassurance that you're in a good position to get a mortgage, even though pre-approval doesn't actually guarantee you a home loan. And that, in turn, could prompt a seller to accept your offer over another. If your income and/or credit score are not good enough to qualify for a mortgage with a desirable rate, you could ask a parent to co-sign your application.

Home loan pre-approval can either be obtained directly through your lender, or with the help of a mortgage broker intermediary. Each financial institutions’ process will look slightly different; however, you will typically meet for a discussion with your lender or broker, and all your necessary information will be recorded. At the conclusion of this meeting, your home loan professional will take your disclosed information and conduct their assessment.

What Are The Pros And Cons Of Pre

This means that the lender has looked at your financial history and determined that you would be a good candidate for a loan. The pre approval process is usually completed online and does not take very long. Although mortgage pre-approval is a promise from a lender, it’s not a guarantee. When you’re ready to close, the lender will do one final financial check to see if your finances have changed since the pre-approval was made.

Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication. If your loan application is denied post pre-approval it may be best to withhold from immediately placing another application. Each time you apply for pre-approval, or a loan, this will be marked on your credit report as an enquiry.

Difference between pre-approval and pre-qualification

If you’re applying with a co-applicant, they’ll need to provide the same information. Since completing a pre-approval application does affect your credit score, getting a free check that won’t impact your credit will give you a rough idea of your current score. You can then use the estimate as a baseline for checking if you meet a lender’s mortgage qualifications. While the borrowing options might be narrow, some lenders might offer a mortgage with some added requirements. One of the first details your lender will review is your credit score.

Also, changes in your credit reports that occurred after your profile was prescreened may disqualify you. Say a lender reviewed your credit profile when you weren’t carrying a balance on any of your credit cards. If you end up having a financial emergency and have to max out your credit cards to pay for it, your credit reports can substantially change — that difference in your credit reports could result in a denial. Companies review information in your credit reports, or from other third parties, against a set of criteria. If you meet the company’s requirements, then it may send you a preapproved loan offer inviting you to apply for a loan. Getting preapproved for a loan helps sellers feel confident that they aren’t wasting their time with an insincere buyer looking at dream cars or homes they can’t afford.

How Much Down Payment Do You Need on a House?

While your finances are a significant factor, getting a mortgage pre-approval is a way to ensure you know exactly how much buying power you have. Any advice contained in this document has been prepared without taking into account your particular objectives, financial situation or needs. For that reason, before acting on the advice, you should consider the appropriateness of the advice having regard to your own objectives, financial situation and needs. Where the advice relates to the acquisition, or possible acquisition, of a particular financial product, you should consider the Product Disclosure Statement before making any decision regarding the product. It also means that, if you're bidding at an auction, you'll have a maximum bid in mind. If you haven't planned for changes in your life, and you've borrowed 95% of the property's value, it can be high pressure.

Once you’re armed with approval in principle, you can go house-hunting with a clear and realistic idea of your overall budget. You can start the application process any time, but it may be a smart move to not apply too early in the game, if you are not serious about looking to buy. It’s a good idea to think about the loan term and different types of home loans at this point too. Your lender can help you understand whether a fixed interest rate or variable rate loan, or a combination of both, is best suited for you. It’s really important to understand that approval in principle does not guarantee a loan approval.

But a preapproval is only a conditional green light that you’ll qualify for a specific loan; it doesn’t guarantee final loan approval. Final loan approval is contingent on other conditions and specifics. For example, the lender will likely want to approve the specific car or home you’re purchasing before approving the funds.

The full mortgage loan process often takes between 30 and 45 days from underwriting to closing. And the next time you’re considering taking out a personal loan, look for preapproved loan offers in the mail. These can show you what types of offers and terms you might qualify for.

Multiple applications can reflect poorly on your credit rating, as it may appear that your financial situation is unstable. You’re likely to face the same issue if you apply for pre-approval with different lenders at the same time. This stage involves an assessment of your situation by the lender, although it’s still not a guarantee of your final loan application being approved – some further checks will be required. For approval in principle, you may need to provide additional proof of the financials you shared in the first step online, so the lender can confirm those details. To apply for easy home loan pre approval and instant mortgage pre approvals from leading banks – HDFC pre approved home loan & ICICI pre approved home loan– call Loanfasttrack today.

For one, it can help you get a handle on how much house you can afford. Pre-approval can also help you stand out from the sea of other home buyers in a competitive housing market. In short, it ups that odds that your home-buying journey will be smooth and successful. Even if you receive a mortgage pre-approval, your loan can still be denied for various reasons, such as a change in your financial situation. According to a report, about 8% of home loan applications get denied, depending on the location.

Comments

Post a Comment